Quick Links

News

-

New Article published in European Accounting Review

A new publication co-authored by Prof.Dr. Sellhorn and Dr. Katharina Weiß on Audit Committee Chairs' Objectives and Risk Perceptions has been published in the European Accounting Review.

-

Carbon Accounting Workshop held at IESE Business School (Munich Campus)

Carbon Accounting Workshop held at IESE Business School (Munich Campus)Workshop on corporate carbon emissions accounting and reporting successfully held at IESE Business School (Munich Campus) together with other academics, company representatives and policy-makers.

-

Prof. Sellhorn appointed to Corporate Reporting Working Group

Prof. Sellhorn appointed to Corporate Reporting Working GroupProf. Dr. Sellhorn has been appointed to Corporate Reporting ISC Consultative Working Group (CR-CWG), established by ESMA.

-

Excellent education for auditors!

Excellent education for auditors!The latest university study by manager magazin in cooperation with Wissenschaftliche Gesellschaft für Management und Beratung mbH (WGMB) honors LMU for excellent teaching in the subject of auditing.

-

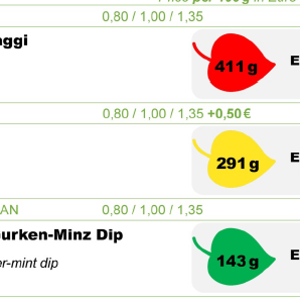

CO2 labels influence eating behavior

CO2 labels influence eating behaviorA field trial showing that labelling the carbon footprint of food prompts people to eat more sustainably is published.

Events

-

12 Apr—30 AprExternal Event: KPMG Summerclash

12 Apr—30 AprExternal Event: KPMG SummerclashOur external partner KPMG offers students a further interesting career event to gain insights into practice. Application possible until end of April.